Content

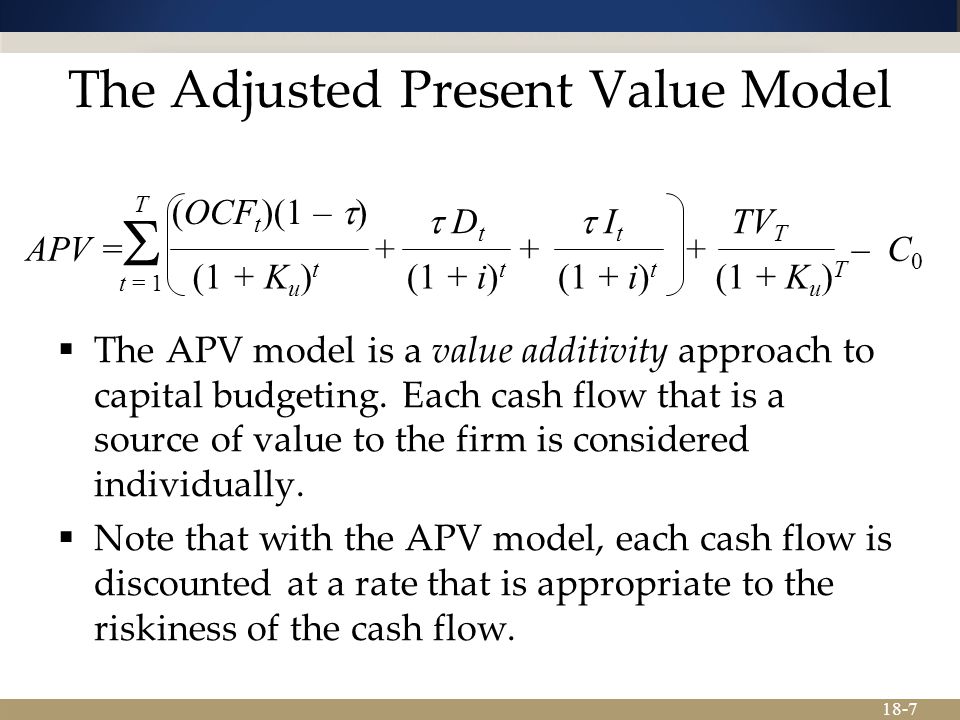

The Price/Earnings ratio measures the relationship between a company’s stock price and its earnings per share. A low but positive P/E ratio stands for a company that is generating high earnings compared to its current valuation and might be undervalued. A company with a high negative P/E ratio stands for a company that is generating heavy losses compared to its current valuation.

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating indiv idual securities. Companies with a positive P/E ratio bellow 10 are generally seen as “value stocks” meaning that the company is already very profitable and unlikely to strong growth in the future. Bloomberg The Open Jonathan Ferro drives you through the market moving events from around the world on Bloomberg’s The Open.

(Real Time Quote from BATS)

Because of this, PE Ratio is great to evaluate from a relative standpoint with other similar companies. The PE Ratio, or Price-to-Earnings ratio, or P/E Ratio, is a financial ratio used to compare a company’s market price to its Earnings per Share . It is the most widely used ratio in the valuation of stocks. Dividend yield allows investors, particularly those interested in dividend-paying stocks, to compare the relationship between a stock’s price and how it rewards stockholders through dividends.

The firm’s three-pronged business model approach of direct sales, servicing, and charging its EVs sets it apart from other carmakers. Tesla, which is touted as the clean energy revolutionary automaker, is much more than just a car manufacturer. The market capitalization sometimes referred as Marketcap, is the value of a publicly listed company. In most cases it can be easily calculated by multiplying the share price with the amount of outstanding shares.

Does TSLA pay dividends? If so, how much?

The beta is 2.07, so Tesla’s price volatility has been higher than the market average. Investors need to be aware that the PE Ratio can be misleading a lot of times, especially when the underlying business is cyclical and unpredictable. As Peter Lynch pointed out, cyclical businesses have higher profit margins at the peaks of the business cycles. Their earnings are high and PE Ratios are artificially low. It is usually a bad idea to buy a cyclical business when the PE Ratio is low. A better ratio to identify the time to buy a cyclical businesses is the PS Ratio .

Founded in 2003 and based in Palo Alto, California, Tesla is a vertically integrated sustainable energy company that also aims to transition the world to electric mobility by making electric vehicles. The company sells solar panels and solar roofs for energy generation plus batteries for stationary storage for residential and commercial properties including utilities. Tesla has multiple vehicles in tesla pe history its fleet, which include luxury and midsize sedans and crossover SUVs. The company also plans to begin selling more affordable sedans and small SUVs, a light truck, a semi truck, and a sports car. Global deliveries in 2022 were a little over 1.3 million vehicles. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors.